|

|

Asset Class & Market Outlook May 4, 2009 This client update is presented in a Q&A format. Do you think new bull markets are under way in some asset classes?We believe new cyclical bull markets have started in numerous assets classes. A cyclical, or shorter-term, bull market can take place within the context of a secular, or longer-term, bear market. Cyclical bull markets can last from several months to several years. Secular bull markets can last for twenty years or more. We do not believe a new secular bull market has started in risk assets. Numerous signs of probable cyclical bottoms are clearly evident in several markets and assets classes. The process of making a bottom has several steps, which take months to complete. The following asset classes have recently completed the last step in what appears to be a bottoming process:

The markets and asset classes below appear to be completing the last step of a probable bottoming process:

If you believe new bull markets may have started, why have you been waiting to buy?As stated above, markets take time to bottom. Our strategy is based on patiently waiting for observable evidence of a probable long-term trend change. Major trends do not change very often. Therefore, you always give the current primary trend the benefit of the doubt until sufficient evidence emerges signaling a change in market direction. Guessing or trying to pick bottoms and tops is a fool's game, especially over any extended period of time. No major U.S. stock market had completed the last step of a probable bottoming process until the NASDAQ made an important higher high on April 16, 2009. The NASDAQ's move confirmed the positive developments we had already witnessed in many emerging markets (China, Brazil, Taiwan, etc.). Markets often retrace or correct big moves shortly after an important new high is made. When the NASDAQ made the higher high on April 16, 2009, many asset classes were extended or overbought. Consequently, it was, and still is to some extent, prudent to remain patient.

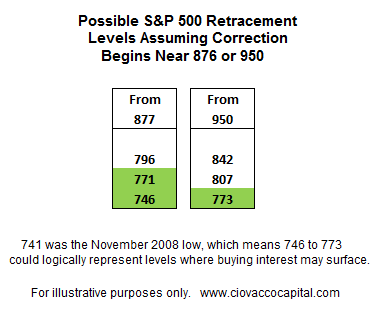

What are the markets telling us now?If the S&P 500 Index can hold above the 876-884 range, it could move into the 950-970 range before we see a significant correction. It is also possible that a significant correction begins near current levels; although that is becoming less probable the longer we stay near or above 876. In either instance, we can expect to see a correction of some significance occurring in the next few weeks. As a result, we should remain selective and patient while keeping position sizes small relative to a portfolio's total value. Most market leading asset classes made their recent lowest low between November and December 2008. Leading markets successfully retested those lows during the March declines. Lagging markets, such as the S&P 500 Index, made new lows in March of 2009. The laggards may still have to retest the March 2009 lows before the next leg of a cyclical bull market can take place. The chart below shows areas where market professionals will be looking to possibly buy in the event of a correction. The purpose of the chart below is not to forecast, but to better understand possible outcomes.

Could you be wrong?Yes. Numerous fundamental problems remain, including:

However, in addition to the widespread evidence of probable trend changes in the financial markets, we have also seen positive developments in the form of:

How do we plan to proceed?Since (a) market trends do not change very often, and (b) we could be wrong about a probable shift in current trends, our strategy calls for us to slowly migrate from a bear market allocation to a bull market allocation. If we take small steps back toward bull market assets, we can remain defensive with a portion of our assets in the event the secular bear market pushes us to lower lows. If our first steps back toward a more aggressive posture are profitable, we can continue the migration process. If we sit on our hands and ignore the positive evidence at hand, we may miss an opportunity to participate in the early stages of a cyclical bull market. Our job is to assess risk and determine when favorable risk-reward trade-offs exist in asset markets. We believe we are seeing the first stages of an environment that may be more favorable for investors.

What are the fundamentals driving our asset allocation strategy?Central bankers and governments around the globe have pumped an unprecedented amount of monetary and fiscal stimulus into the economy and financial markets. With almost all asset classes participating in the recent bear market, there is pent-up demand for bull markets along with plenty of idle cash ready to move off the sidelines. As global economic numbers improve from very low levels, the demand for so-called "safe haven" assets, such as U.S. Treasury bonds and the U.S. dollar, will begin to recede from very high levels. While the U.S. dollar remains in a bullish stance, we have seen some cracks appear in recent weeks. It appears as if the markets are looking forward to a resumption of the U.S. dollar's decline vs. other currencies. If the dollar does indeed begin to weaken again, it will increase the demand for numerous assets, such as commodities, commodity-related currencies, and emerging market stocks. Any continued economic weakness or problems in the financial system will be met with more printed money, government bailouts, and spending, which will continue to support rising asset prices. While far from heading back to previous boom times, China's economy has shown signs of stabilization. The China growth story continues to support investments in commodities and emerging market stocks.

What asset classes and markets look most attractive? The colored column in the chart above shows the change in the CCM Ranking from the prior week. Notice the strong move up by commodity-related investments. The increased interest in commodities may be forecasting some improvements in the global economy.

Does this mean we can expect less volatile markets?Relative to volatility in October and November 2008, the answer is yes. However, we should expect some volatile and unsettling periods in the months ahead. If the process of retesting the March lows is in the cards, then volatility will pick up again. Even in the context of a secular bull market, volatility and significant corrections are to be expected.

What about gold?Gold is one of the few assets that can perform well in both deflationary and inflationary environments. At the moment, the markets are not overly concerned about inflation or deflation, which reduces the appeal of gold. We should also expect gold to underperform as investors focus their attention on "cheap" paper assets and the possibility of an improved economic outlook. At some point in the process of the economic recovery, inflation will become a concern, which will again increase the interest in holding gold. If an economic recovery fails to materialize and deleveraging continues at a rapid pace, gold will pick up support in the form of safe haven and deflationary concerns. We will manage gold just like any other asset. If it fails to prove itself via continued weakness, we will protect principal at the proper levels. For now, gold should be given a little more rope and a little more time. Gold performed very well during the 2003-2007 bull market in stocks. The fact that stocks are performing better does not mean gold automatically should be sold. We have seen some weakness in gold, which we will monitor closely.

Chris Ciovacco

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes any representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

|