|

Home CCM

|

2010-2011 Market Outlook Asset Price Inflation - Policy Makers Have Little Choice But To Inflate

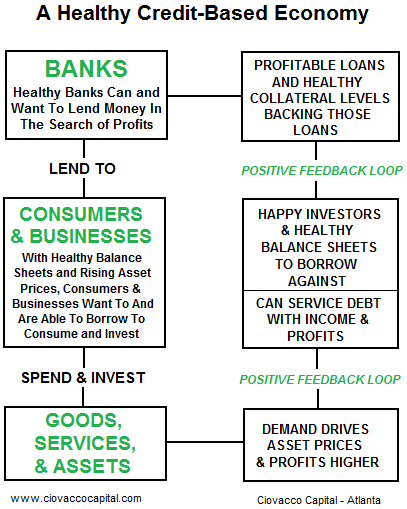

When banks have healthy balance sheets they can lend more freely. When businesses and consumers have healthy balance sheets they can borrow more easily. As asset prices rose in the boom years, the asset side of balance sheets also became more healthy, allowing banks to lend more and consumers and businesses to borrow more. The loan recipients in turn, used borrowed monies to buy consumer goods and assets, such as stocks, bonds, commodities, and real estate. Access to credit increased the demand for all assets, which drove up the price of assets, which made the balance sheets of banks and consumers even healthier. This is known as a positive feedback loop. It all works well as long as asset prices are rising. Banks are happy, businesses are happy, and consumers are happy and willing to spend, invest, and consume. You can take on more liabilities if the asset side of your balance sheet is rising. This is what happened in the 1990s and from 2003-2007.

Unfortunately, at some point the music stops, and asset prices begin to fall setting off a negative feedback loop or bust, as we saw in 2000-2002 and 2007-2009. As asset prices fall and liabilities remain basically constant, the balance sheets of banks, businesses, and consumers begin to deteriorate. As balance sheets weaken, the ability of banks to lend, and consumers and businesses to borrow is reduced. When access to credit is reduced, it reduces demand in all markets from chewing gum to commercial real estate. When demand falls, prices fall. When asset prices fall, it damages the asset side of the balance sheet, which reduces the ability to lend and borrow even further. Around and around we go in a negative feedback loop until one of two things happens; either (1) asset prices begin to rise, and/or (2) liabilities are reduced. Negative feedback loops of this kind are not good for politicians, especially with mid-term elections approaching fast. The negative feedback loop helps push up the unemployment rate, which is bad news for an incumbent who may be up for re-election. These circumstances leave the Federal Reserve and politicians with two ways to attack the problem; (1) attempt to reduce liabilities on the balance sheets of banks, businesses, and consumers, and/or (2) attempt to improve the asset side of balance sheets via bailouts, cash infusions, or by the inflation of asset prices via loose monetary and fiscal policy. Bailouts are never popular. Having the government step in and force private parties to renegotiate loan and contract terms in an effort to reduce the liability side of balance sheets is often viewed as un-American. For example, 'cramdown' legislation related to reducing a consumer’s mortgage liability has experienced fierce opposition. The last alternative for policymakers in their quest to repair balance sheets, stop the negative feedback loop, and reduce the not-easy-to-get-reelected-unemployment figures is to inflate asset prices. No one likes bailouts. No one likes the concept of a 'cramdown'. However, not many people complain when the value of their 401(k), real estate, or precious metals portfolio increases in value. In today’s world, assets on the balance sheets of banks, businesses, and consumers include:

We can illustrate how the inflation of asset prices can restore balance sheets back to health via an extreme and unrealistic example. Hypothetically, assume the government passed a law mandating that effective immediately the value of all residential and commercial real estate was to be valued at twice its existing market price. In theory, you would be doubling the value of some assets on balance sheets while keeping liabilities constant. Presto - by increasing the value of asset prices, policy makers can assist in the healing of sick balance sheets. Obviously, a law such as the one used in this example is not about to be enacted, but policy makers do have tools at their disposal that can help them inflate asset prices. They include:

From an investor's perspective, it is nearly irrelevant whether or not we agree with these policies. It is what it is and things are not likely to change anytime soon. If you are skeptical about the need to inflate asset prices, we suggest you consider the alternative. If asset prices continue to fall, in a global economy that is up to its eyeballs in debt, the negative feedback loop will morph into a deflationary spiral which becomes very difficult to stop. It is much easier to attempt to inflate than attempt to reverse a deflationary depression. The decisions about debt levels and the direction of policies were made long ago. We believe given the circumstances and political pressures, the Fed will err on the side of policies that lead to asset price inflation, while mostly paying lip service to their "concerns" about consumer price inflation. As investors, we must protect ourselves from the substantial risk of a significant reduction in the purchasing power of the paper money we currently hold. We feel the proper course of action would have been to let the bubbles pop in 2000, which would have forced the system to reduce and purge debt. It would have been painful, but it would have set the stage for a more sustainable recovery. Like dealing with Social Security and Medicare, no politician wants to make the difficult decisions related to a much needed purging of debt on their watch, since it may be harmful to their reelection bid. The easier thing to do is to continue to kick the can down the road and attempt to reinflate asset prices one more time. We feel policymakers will use all means necessary in their attempt to get asset prices rising and balance sheets repaired. If you think that is a strong statement, consider it in the context of recent and current policies, such as the Fed buying government bonds (monetizing the debt a.k.a. money printing), a near zero interest rate policy that punishes savers and encourages speculation, government ownership stakes in numerous businesses from GM to AIG, government guarantees on all sorts of private debt, etc. Fed Chairman Greenspan allowed the NASDAQ bubble to inflate. Greenspan and Bernanke allowed the housing and commodity bubbles to inflate. If you bet against them in the current environment, you are betting against powerful people and institutions that have the ability to print unlimited amounts of new U.S. dollars (for now at least). Regrettably, we believe it will all end badly at some point, but that could be years and years from now. In the meantime, it appears as if the Feds have been successful in their efforts to ignite new bull markets. It is what it is and is not likely to change anytime soon. We don’t have to like it, but we can still attempt to profit from it as a means to protect our purchasing power. While CCM relies heavily on technical analysis when making portfolio management decisions, we do so with an understanding of the importance of fundamental trends. Our experience indicates fundamental trends do not change very often. Our job as money managers is to make note of, and act on, trends currently driving asset prices. Since the late 1990s, the financial markets have been primarily driven by balance sheets and the ability to lend and borrow against those balance sheets. Not much has changed as we head into 2010.

Chris Ciovacco

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com Ciovacco Capital would like to thank StockCharts.com for helping us create great looking charts. Terms of Use. The charts and comments are only the author's view of market activity and aren't recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations aren't predictive of any future market action rather they only demonstrate the author's opinion as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

|