|

Home

|

CCM Client Update Outlook & Strategies For Full-Year 2010 January 28, 2010

Beginning on January 20, 2010, global stocks (MSCI World Index) dropped for six straight days, with several markets seeing very steep declines in a compressed period. In light of recent events, we wanted to give you a quick strategy update.

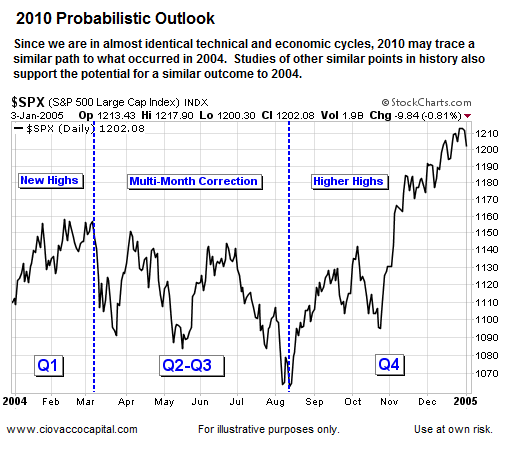

Based on extensive research of past market cycles, we still anticipate a move on the S&P 500 toward 1,200 to 1,250 in Q1 or early in Q2 2010. Numerous fundamental and technical factors also point to the potential for an intermediate-term correction beginning in Q1 or Q2 and ending in early Q4. The good news is we would anticipate the market would then go on to make new highs (above 1,250) in Q4. Despite the current correction, there is little evidence to support the return of a prolonged bear market in 2010. These comments are based on studies of past economic, market, and presidential cycles. The outlook is based on probabilistic outcomes within the context of the current environment and historical activity during similar periods. Thus far, the markets have moved in a manner that aligns well with the historical script. We do not make investment decisions based solely on historical cycles; they are one of many inputs in our approach to the markets. In the chart below, it is the general market direction and approximate time of year that are relevant, not specific dates or specific percentage changes up or down. The historical bias is for higher highs, a correction, then, further gains as we close out the year.

In 2010, year-end values for the S&P 500 could approach 1,300 to 1,350 (1,200 is relevant to 2004, not 2010).

Markets Remain HealthyIf we see negative (a.k.a. bearish) divergences as the markets make the next push higher, our plan is to reduce risk by cutting back on our exposure to more volatile markets. We did not see significant divergences as the markets made their highs in early January, which is indicative of a healthy market. Therefore, the odds continue to favor at least one more attempt at higher highs in Q1 or early Q2. When the S&P 500 made new highs in early January 2010, we still had:

Unlike what we saw earlier this month, markets typically exhibit internal weakness prior to beginning multi-month corrections (see example below). While any future outcome is possible, rapid declines from current levels with no intermediate periods of strength are not highly probable. Even if the markets fail to make new highs again in Q1 or Q2, they should still experience periods of strength within the context of an intermediate downtrend. Therefore, even in the worst case scenario (correction has already started), we should have an opportunity to pare back on some of our more volatile positions during a period of intermediate strength. The markets never go straight up or straight down. If we see negative divergences as markets move higher, we will make adjustments if needed.

Key PointThere is little evidence to support the return of a prolonged bear market in 2010. Even if we get a correction that lasts several months, the odds favor higher highs either later in 2010 or in 2011. Therefore, most markets and asset classes should be higher or worth more on January 1, 2011 than they were on January 1, 2010. The only way to capture those gains is to put our shorter-term and intermediate-term fears aside and remain close to fully invested. If we see negative divergences, it may be prudent to reduce risk or shift some of our assets to more conservative options, but we must also keep a portion of our assets invested in stocks, commodities, and currencies in order to have an opportunity to participate in what should be ongoing longer-term bullish conditions. We are in confirmed bull markets in almost every risk asset class. That was not the case on January 1, 2009. Conditions have improved. Our focus can shift to a longer time horizon.

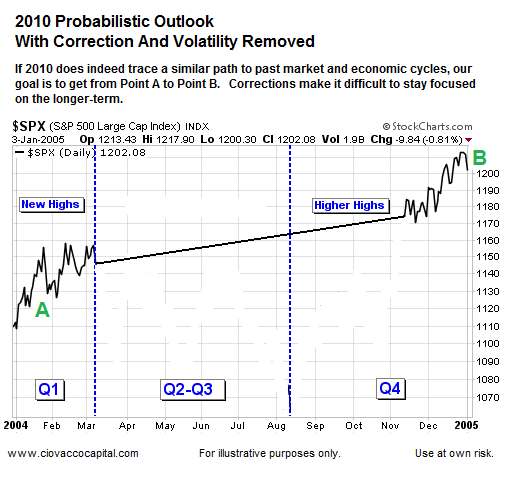

Fear Of Corrections Can Reduce ReturnsWe cannot be overly concerned about market corrections within the context of a bull market. Constant fear of corrections makes it difficult to stay invested. People are living longer. Inflation pressures are building. Investing is about making money in the long-term, not about trying to avoid every uncomfortable correction. Our odds of making money in the longer-term improve significantly if we have a longer-term focus (during bull markets). Our research favors higher asset prices in almost all risk markets one year from now. Therefore, we should be less concerned about where asset prices are in three days, three weeks, or three months.

More Conservative OptionsUnfortunately, with the Fed having interest rates at basically zero, CD rates are extremely low. With a starting point of zero, rates have nowhere to go but up. That means all investments with attractive yields (stocks, bonds, REITs, higher-yield CDs, etc.) are going to come under some additional price pressure as interest rates begin to rise. Chasing yield or dividends in this environment can be dangerous, especially for inexperienced investors. Those who are loading up on income producing instruments could be in for a rude awakening when interest rates inevitably begin to trend higher (a process that may have already begun).We are currently looking at some conservative fixed income options that have historically performed well in a rising interest rate environment. If the markets show bearish divergences in the weeks and months ahead, we may park some money in low-yielding and short-maturity fixed income investments. Our objective would be (a) preservation of capital, and (b) to beat extremely low CD and money market rates.

Long-Term Outlook Remains PositiveIn the very short-term, the best thing we can do is remain patient. We will make decisions in the coming weeks based primarily on the internal health of the financial markets. Corrections are a normal part of any bull market. If we want to have a successful 2010, it will be necessary to remain focused on the longer-term trends and not be derailed by intermediate or short-term corrections.

Chris Ciovacco

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com Ciovacco Capital would like to thank StockCharts.com for helping Short Takes create great looking charts. Terms of Use. The charts and comments are only the author's view of market activity and aren't recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations aren't predictive of any future market action rather they only demonstrate the author’s opinion as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

|