|

Home

|

CCM Client Update New Tool To Help Increase Holding Periods And Reduce Transactions March 25, 2010

As we highlighted in late 2009/early 2010, financial market volatility has increased the need for sound money management strategies and tactics during market corrections. The 9.2% drop in the S&P 500 from January 19 to February 5 reinforced the point early in 2010. For a variety of reasons, we expect market volatility to continue during the current bull market cycle. In response, we have developed a new tool to help us strike a better balance between protecting your hard-earned principal and remaining invested to capture bull market gains.

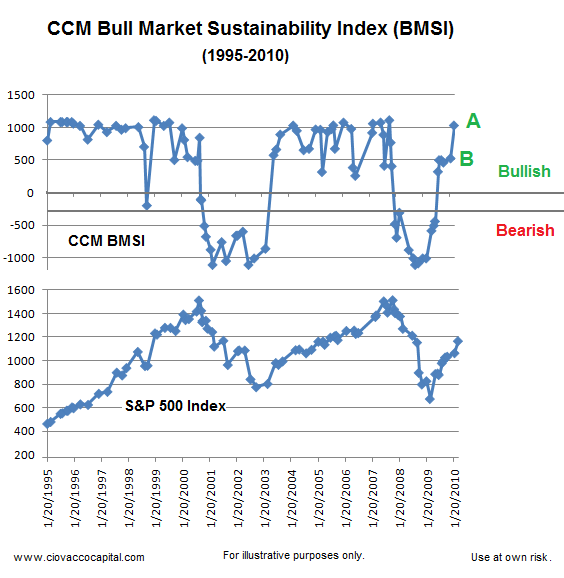

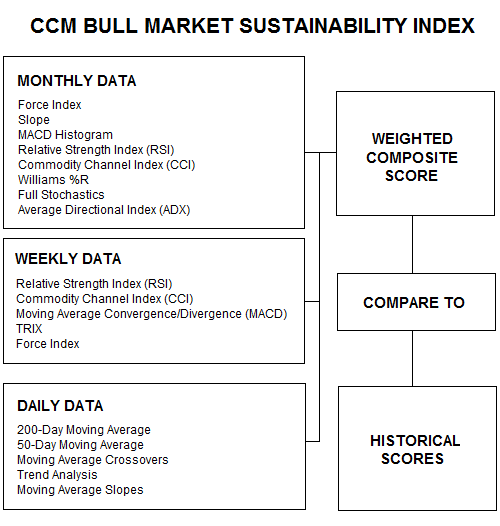

The CCM Bull Market Sustainability Index (BMSI) is shown below (top) with the S&P 500 Index (bottom). The BMSI uses a proprietary scoring system to monitor the health of the stock market during corrections and bear markets, helping us better discern between the two. The points shown on the first graph below are the BMSI scores for the S&P 500 at important market lows. Scores above zero are indicative of bull market conditions, where the majority of positions should be held during corrections. Scores between zero and -200 represent weak market conditions where the risks of shifting to a new bear market are elevated. Scores below -200 have coincided with bear market conditions where principal protection becomes more important than remaining invested.

Point A (above) is the S&P 500's score as of March 24, 2010, which aligns well with healthy bull market scores in the past. Point B, which also compares favorably with historical bull market readings on the BMSI, represents the score for the S&P 500 at the last stock market low made on February 5, 2010.

Identifying Possible Bear MarketsThe CCM BMSI dropped into bear market territory at the intermediate stock market low made on November 29, 2000 with the S&P 500 trading at 1,341. After the bearish BMSI signal in 2000, the S&P 500 dropped 42% to 775 over the next 23 months. At the intermediate market lows on January 8, 2008, the BMSI again dropped into bearish territory with the S&P 500 trading at 1,390. After the bearish signal in early 2008, the S&P 500 fell 52% before finding a bottom in March of 2009. This new tool should allow us to significantly increase our holding periods for investments in bull markets while helping us identify the possible onset of a new and prolonged bear market.

During the next corrective action in stocks, which is inevitable at some point, we will use this new tool to help better discern between a correction and the possible beginning of a new bear market. We will continue to conduct research in this area and adjust the CCM BMSI as needed.

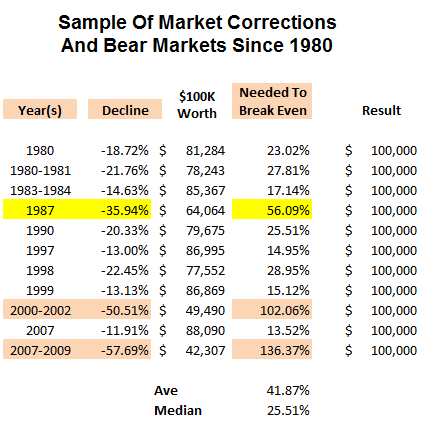

Principal Protection Especially Important In Bear MarketsThe importance of protecting principal is illustrated via the table below, which shows a sample of significant stock market corrections and bear markets that have taken place since 1980. Highlighting one example below, the 35.94% stock market decline in 1987 required a subsequent gain of 56.09% for an investor to regain their lost principal.

2010: Troubles In Europe Call For DiversificationBudgetary concerns continue to put a strain on the European Union's currency, the euro. This has contributed significantly to a stronger than expected dollar in recent months. A strong dollar has muted the relative strength of many assets that tend to lead at this stage of an economic recovery, including commodities and emerging market stocks. With other nations in the European Union carrying heavy debt burdens, it is possible the euro remains under pressure for an extended period. Consequently, it is prudent to consider adding some assets to our portfolios that are impacted less by a strong dollar.

Attractive AssetsWe recently updated both our current market and historical cycle models, which enable us to compare 190 markets, sectors, and asset classes head-to-head. The results favor the following for the balance of 2010:

CCM's composite asset class rankings can help us make better allocation decisions in the coming months. U.S. based commodity stocks are a little less susceptible to a strong dollar than physical commodities, such as copper and silver. U.S. stocks offer some advantages over emerging market stocks in a strong dollar environment. The situation in Europe and the stronger than expected dollar factored into our decision to reduce our exposure to specific emerging market countries and physical commodities in some accounts. We may redeploy some of that capital into transportation, small-cap, and technology stocks. A broad based U.S. stock index may also be incorporated into some portfolios to help reduce the possible negative impacts of a strong dollar.

Employment Gains May Arrive SoonEmployment gains tend to come late in an economic recovery cycle, so weak employment figures in 2009-2010 have not been all that surprising. However, in a global economy heavily dependent on consumers, hiring remains an important part of a sustainable economic rebound. Any improvement in hiring and the unemployment rate could provide a further boost for both stocks and commodities. According to John Challenger, CEO of Challenger, Gray & Christmas (a well-known outplacement consulting organization), job creation may not be far off due to the following:

Cautious businesses may opt to ramp up staff with temporary workers in the early stages of an economic recovery. Often, the next step is to add permanent staff. The number of temporary positions increased by 284,000 in the past five months, which may be indicative of an improving employment picture for permanent positions in the coming months. Additional comments can be found in Short Takes.

Chris Ciovacco

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com Terms of Use. The charts and comments are only the author's view of market activity and aren't recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations aren't predictive of any future market action rather they only demonstrate the author's opinion as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

|